south dakota sales tax rate changes 2021

10 rows Raised from 45 to 65. Tax rates are provided by Avalara and updated monthly.

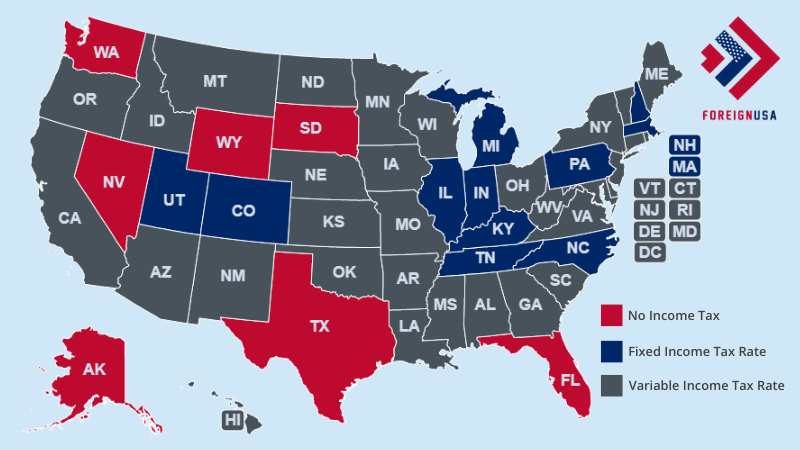

State Income Tax Rates Highest Lowest 2021 Changes

Your businesss gross revenue from sales into South Dakota exceeded 100000.

. South Dakota is ranked number twenty seven out of the fifty states in order of the average amount of property taxes collected. State State Sales Tax. Beginning January 1 2022 the town of Lane is implementing a new municipal tax rate from 0 percent general sales and use tax rate to 2 percent.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. The Richland sales tax rate is. The Kyle South Dakota sales tax rate of 45 applies in the zip code 57752.

If you need access to a regularly-updated database of sales tax rates take a look at our sales tax data page. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year.

This page allows you to browse all recent tax rate changes and is updated monthly as new sales tax rates are released. The state sales tax rate in. Tax rates are provided by Avalara and updated monthly.

The state sales tax rate in South Dakota is 45 but you can customize this table as. Look up 2021 sales tax rates for Cresbard South Dakota and surrounding areas. For example you may prefer to use a street map vs.

South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. An alternative sales tax rate of 45 applies in the tax region Jackson which appertains to zip code 57752.

12-01-2021 1 minute read. Exact tax amount may vary for different items. You may want to change the basemap.

A topographic map so you can easily. What Rates may Municipalities Impose. You can print a 65 sales tax table here.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined. Did South Dakota v. Look up 2021 sales tax rates for Day County South Dakota.

Mitchell was collecting a. All South Dakota municipal sales tax rates will remain the same on January 1 2021. We provide sales.

For tax rates in other cities see South Dakota sales taxes by city and county. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. South Dakota municipalities are able to implement new tax rates or change existing tax rates on.

Supreme Court decision eliminating the physical presence standard for sales tax nexus nearly every state with statewide sales taxes have adopted collection and remittance obligations for remote sellers and several have implemented marketplace facilitator regimes. Look up 2021 sales tax rates for Mission Hill South Dakota and surrounding areas. As of January 1 2021.

There is no applicable county tax or special tax. 2021 South Dakota state sales tax. Tax rates provided by Avalara are updated monthly.

The County sales tax rate is. Sales Tax Rates by Address. State State Sales Tax.

It allows you to easily identify where points are located. South dakota v. What is Change Basemap.

There are approximately 1296 people living in the Kyle area. 38 rows 2021 State. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6.

Simplify South Dakota sales tax compliance. A basemap is the background map that provides reference information for the other layers. In addition the town of Henry is amending their municipal tax rate from 1 to 2.

The South Dakota sales tax rate is currently. Municipalities may impose a general municipal sales tax rate of up to 2. Following the 2018 South Dakota vWayfair US.

31 rows South Dakota SD Sales Tax Rates by City. South Dakota law also requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one or both of the following criteria in the previous or current calendar year. Still Mitchells first- and second-penny sales tax grew 9 in 2021 compared to 2019 figures.

The South Dakota Department of Revenue administers these taxes. This is the total of state county and city sales tax rates. What is South Dakotas Sales Tax Rate.

The South Dakota sales tax and use tax rates are 45. 2022 List of South Dakota Local Sales Tax Rates. March 2022 Sales Tax Changes - 181 changes in 24 states.

The minimum combined 2022 sales tax rate for Richland South Dakota is. The 65 sales tax rate in Beresford consists of 45 South Dakota state sales tax and 2 Beresford tax.

South Dakota Sales Tax Rates By City County 2022

Vape E Cig Tax By State For 2022 Current Rates In Your State

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Sales Tax By State Is Saas Taxable Taxjar

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Navigating Freelance Taxes In 2020 Managing Finances Filing Taxes Tax

South Dakota Sales Tax Guide And Calculator 2022 Taxjar

How High Are Capital Gains Taxes In Your State Tax Foundation

States With Highest And Lowest Sales Tax Rates

Sales Use Tax South Dakota Department Of Revenue

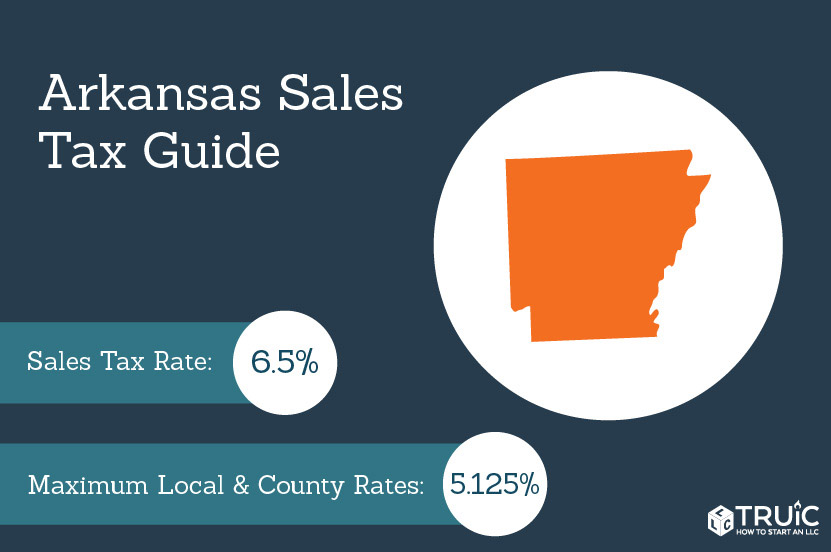

Arkansas Sales Tax Small Business Guide Truic

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)